More About Custom Private Equity Asset Managers

Wiki Article

The Basic Principles Of Custom Private Equity Asset Managers

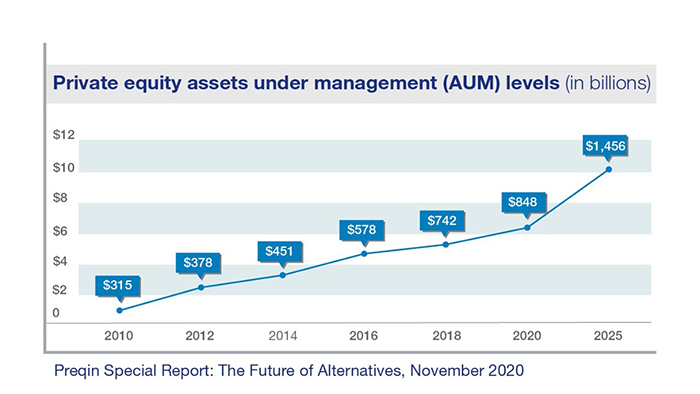

(PE): spending in companies that are not openly traded. Approximately $11 (https://www.evernote.com/shard/s663/sh/78f8afd3-421c-a28b-04f9-3d6f5b83621f/ome7lGPiSzHoRYJQyAoDvVbVWfkAw8Jt2BLyZOMkla8rOCrlw9A55i4ORg). There might be a couple of points you do not comprehend concerning the market.

Personal equity companies have a variety of financial investment choices.

Due to the fact that the most effective gravitate towards the larger bargains, the middle market is a significantly underserved market. There are a lot more vendors than there are highly experienced and well-positioned money experts with substantial purchaser networks and resources to handle a deal. The returns of private equity are commonly seen after a few years.

How Custom Private Equity Asset Managers can Save You Time, Stress, and Money.

Flying listed below the radar of huge international corporations, much of these little firms commonly give higher-quality customer care and/or Visit This Link particular niche items and solutions that are not being offered by the large conglomerates (https://peatix.com/user/20144170/view). Such upsides attract the interest of private equity firms, as they have the understandings and savvy to manipulate such opportunities and take the company to the following degree

Personal equity investors should have dependable, qualified, and reliable administration in place. Most managers at profile firms are offered equity and benefit compensation structures that compensate them for hitting their financial targets. Such alignment of objectives is generally needed before a deal obtains done. Private equity opportunities are typically out of reach for individuals who can't spend numerous bucks, yet they should not be.

There are laws, such as limitations on the aggregate quantity of cash and on the number of non-accredited capitalists (TX Trusted Private Equity Company).

Top Guidelines Of Custom Private Equity Asset Managers

One more drawback is the lack of liquidity; once in an exclusive equity purchase, it is not very easy to obtain out of or sell. With funds under monitoring already in the trillions, exclusive equity companies have become appealing financial investment vehicles for wealthy individuals and establishments.

Currently that access to exclusive equity is opening up to even more individual investors, the untapped capacity is becoming a truth. We'll start with the main disagreements for investing in exclusive equity: Exactly how and why private equity returns have actually historically been greater than various other possessions on a number of levels, How including personal equity in a profile influences the risk-return profile, by assisting to branch out versus market and intermittent risk, Then, we will certainly lay out some vital factors to consider and risks for exclusive equity investors.

When it involves presenting a brand-new property right into a portfolio, one of the most fundamental consideration is the risk-return profile of that possession. Historically, exclusive equity has displayed returns comparable to that of Arising Market Equities and greater than all other typical possession courses. Its relatively low volatility paired with its high returns produces an engaging risk-return account.

The Custom Private Equity Asset Managers Diaries

Exclusive equity fund quartiles have the largest variety of returns across all alternative asset courses - as you can see listed below. Methodology: Internal rate of return (IRR) spreads out calculated for funds within classic years individually and afterwards balanced out. Typical IRR was determined bytaking the standard of the median IRR for funds within each vintage year.

The takeaway is that fund choice is essential. At Moonfare, we execute a rigid selection and due diligence process for all funds noted on the system. The result of adding private equity into a profile is - as always - reliant on the portfolio itself. A Pantheon research from 2015 recommended that consisting of private equity in a portfolio of pure public equity can unlock 3.

On the various other hand, the best personal equity firms have access to an also bigger pool of unknown opportunities that do not deal with the very same examination, in addition to the sources to perform due diligence on them and recognize which deserve purchasing (TX Trusted Private Equity Company). Investing at the very beginning means greater danger, but also for the companies that do be successful, the fund take advantage of higher returns

A Biased View of Custom Private Equity Asset Managers

Both public and personal equity fund managers devote to spending a percent of the fund yet there stays a well-trodden issue with aligning interests for public equity fund management: the 'principal-agent trouble'. When an investor (the 'primary') works with a public fund supervisor to take control of their funding (as an 'representative') they hand over control to the supervisor while preserving ownership of the assets.

When it comes to private equity, the General Partner doesn't simply make a monitoring fee. They also gain a percent of the fund's revenues in the form of "lug" (normally 20%). This makes sure that the passions of the manager are straightened with those of the financiers. Personal equity funds likewise mitigate another type of principal-agent trouble.

A public equity investor eventually desires something - for the monitoring to raise the stock rate and/or pay dividends. The financier has little to no control over the decision. We showed above exactly how numerous private equity strategies - especially majority buyouts - take control of the operating of the company, ensuring that the long-lasting worth of the firm precedes, pushing up the roi over the life of the fund.

Report this wiki page